Cryptocurreny

Main Anlysis Results

Using a balanced panel data set and a fixed effects model to discuss possible relationships between Google Trends data, stock market prices, the 2020 election and cryptocurrency price changes.

Fixed Effects Model

Using the balanced panel data structure, I run a fixed effects regression models to control for the unobserved variables of each cryptocurrency that do not change over time. For my dependent variable, I transform open price to log open price to account for the large difference in prices across cryptocurrencies.

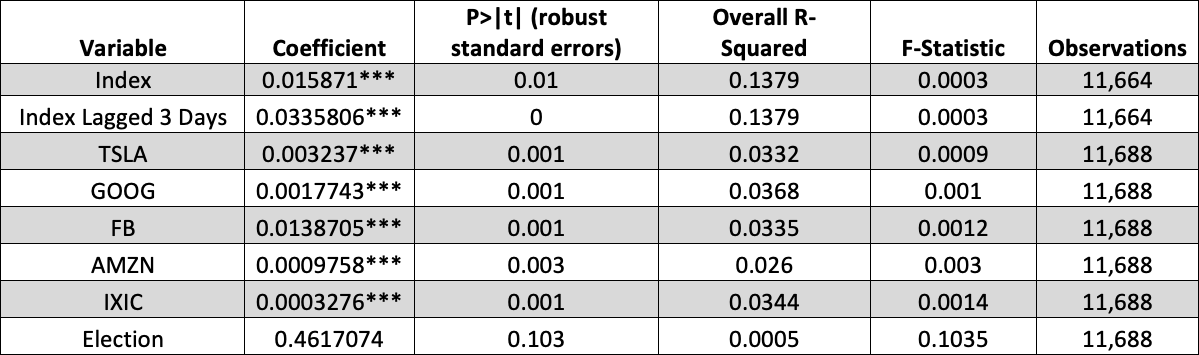

In the results above, we see a positive correlation among all independent variables except the election variable. With over 14,000 observations and 8 groups, the index and stock market results prove to be highly significant at the 99% confidence interval. When adding additional control variables, such as the search term for “Cryptocurrency” the lagged Google Trends variable continues to be significant and positively correlated. This three day lagged Google Trends Index variable may indicate a possible causal effect of Google searches on changes in cryptocurrency prices. However, it is difficult to conclude this is indeed a causal relationship for many reasons.

There are many possible variables and confounding variables that affect changes in cryptocurrency prices and the Google Trends Index. For example, a news article may be released about a major tech company that will accept or back a particular cryptocurrency. This would lead to many people both searching for cryptocurrency term, while also jolting investors into action to purchase digital currencies. Second, it is impossible to say whether people searching for cryptocurrencies is the reason for change in prices or if the true relationship is the other way around. The reality is, cryptocurrency prices and Google searches are likely mutually responsive, meaning changes in prices lead to changes in searches and changes in searches lead to changes in prices.

The next relationship I estimate is between tech company stock prices and log cryptocurrency prices. The results indicate a positive relationship. Meaning, as stock prices for Tesla, Google, Facebook, and Amazon increase, we also see increases in cryptocurrency prices. While these results are significant according to the p-values using robust standard errors, this model is still seriously flawed. The main reason is that cryptocurrency prices are influenced by the price in previous days, weeks, or even years, leading to auto correlation. Another reason is that both stock prices and cryptocurrency prices always have a positive trend. This means over the four-year period studied, we expect the price for both stocks and cryptocurrencies to increase, seriously biasing the results.

In the election variable results, we can see that there is once again a positive relationship. However, according to the p-value, the results are not significant even at the 90% confidence interval. Similar to the Google Trends results, it is once again difficult to prove that the change in cryptocurrency prices is all attributed to the results on the 2020 election. There are likely many factors that led to the spike in cryptocurrency prices shortly after the election and confidence about the future due to Joe Biden’s election may just be one of them.

Fixed Effects Model Conclusion

In the fixed effects model, the assumptions needed to determine a causal relationship between the independent variables on changes in cryptocurrency prices are impossible to prove. However, in the lagged Google Trends index model, we may believe this relationship could possibly be causal. In this model. We see an increase on the lagged index coefficient. This would mean Google searches for cryptocurrency terms increase before changes happen in cryptocurrency prices. While this would need to be true in order to show causality, there are still many other factors at play.

First, we would be assuming individuals use Google to collect information before investing money into the market. However, many people Google searching for cryptocurrency are also doing it out of skepticism or curiosity, and not necessarily to invest. Additionally, there are many other reasons (variables) that changes in cryptocurrency prices may occur. With a more sophisticated model and gigabytes more data (hourly instead of daily), perhaps a causal relationship between these variables would be possible. This leads me to believe these variables are highly correlated, and while a causal relationship may be possible, the fixed effects model is does not provide sufficient evidence to make this claim.